Page 30 - 13.Sayı

P. 30

28 D EF EN S EH ER E A A D 2 0 2 4 E D I T I O N

466 THE MILITARY BALANCE 2024

Increase Cabo Verde Burkina USD0.33bn

Niger

USD0.01bn

Faso

USD0.83bn

Central African Rep

USD0.06bn Ethiopia

Ghana

USD0.34bn USD1.54bn

Benin

USD0.13bn

Burundi Dem Republic

USD0.06bn of Congo

South Sudan USD0.76bn Mali

USD0.05bn USD1.09bn

Chad

USD0.35bn

Rwanda

USD0.19bn Botswana

USD0.55bn

Tanzania

Côte d'Ivoire

Togo Congo USD0.69bn USD1.15bn

USD0.20bn USD0.29bn

Gabon

USD0.27bn

Mozambique

USD0.20bn Zambia

Senegal

Guinea Kenya USD0.45bn South Africa USD0.41bn

Madagascar USD0.50bn USD1.28bn USD2.86bn

USD0.11bn

Cameroon Uganda

Namibia USD0.46bn USD1.01bn Nigeria

USD0.35bn USD1.99bn

Guinea-Bissau

USD0.03bn

Angola

Mauritius USD1.25bn

The Gambia Sierra Leone USD0.24bn Lesotho

USD0.01bn USD0.02bn USD0.03bn Liberia

Decrease Djibouti Equatorial Guinea Eritrea Seychelles Somalia Sudan USD0.02bn USD0.06bn USD0.10bn

Zimbabwe

Malawi

n.k

n.k

n.k

n.k

n.k

n.k

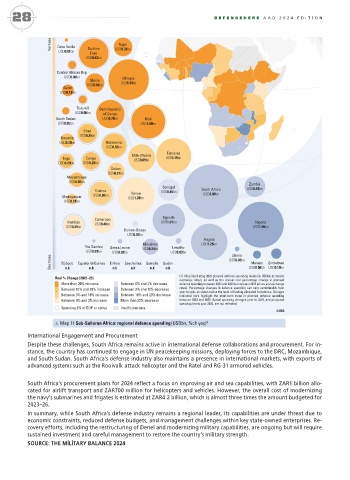

[1] Map illustrating 2023 planned defence-spending levels (in USDbn at market

Real % Change (2022–23) exchange rates), as well as the annual real percentage change in planned

More than 20% increase Between 0% and 3% decrease defence spending between 2022 and 2023 (at constant 2015 prices and exchange

Between 10% and 20% increase Between 3% and 10% decrease rates). Percentage changes in defence spending can vary considerably from

year to year, as states revise the level of funding allocated to defence. Changes

Between 3% and 10% increase Between 10% and 20% decrease indicated here highlight the short-term trend in planned defence spending

Between 0% and 3% increase More than 20% decrease between 2022 and 2023. Actual spending changes prior to 2022, and projected

spending levels post-2023, are not re ected.

Spending 2% of GDP or above Insuf cient data

©IISS

ɺ Map 11 Sub-Saharan Africa: regional defence spending(USDbn, %ch yoy) 1

International Engagement and Procurement ȱȱȱȱȱȱȱȱȱ

ȱȱȱ¢ȱȱ ŬǯŬȱ

ȱŬŪŬŭǰȱ ȱȱ ŬǯŮȱȱŬŪŬŬǯȱ ȱ

¢ȱȱȱ¢ȱǯȱ

Despite these challenges, South Africa remains active in international defense collaborations and procurement. For in-

ȱ ȱ ȱ Ȭ ȱ Ȃȱ

ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ ȱ

stance, the country has continued to engage in UN peacekeeping missions, deploying forces to the DRC, Mozambique,

ǰȱȱ ȱ¡ȱȱȱȱ

ȱ ȱȱȱȱ¡ǯȱ ȱ

and South Sudan. South Africa’s defense industry also maintains a presence in international markets, with exports of

ȱȱȱȱǯȱ ȱǰȱ

ȱ ȱ ȱ ȱ ȱ ŭŰǯŲƖȱ ȱ ȱ

advanced systems such as the Rooivalk attack helicopter and the Ratel and RG-31 armored vehicles.

ȱĚȱȱȱȱȱ¢ǰȱȱ ȱ ȱ ȱ ȱ ŬŪŬŭǰȱ ȱ ȱ ŭŬǯŬƖȱ

South Africa’s procurement plans for 2024 reflect a focus on improving air and sea capabilities, with ZAR1 billion allo-

cated for airlift transport and ZAR700 million for helicopters and vehicles. However, the overall cost of modernizing

the navy’s submarines and frigates is estimated at ZAR4.2 billion, which is almost three times the amount budgeted for

2023–26.

In summary, while South Africa’s defense industry remains a regional leader, its capabilities are under threat due to

economic constraints, reduced defense budgets, and management challenges within key state-owned enterprises. Re-

covery efforts, including the restructuring of Denel and modernizing military capabilities, are ongoing but will require

sustained investment and careful management to restore the country’s military strength.

SOURCE: THE MİLİTARY BALANCE 2024